You swallow eight spiders every year

Have you heard that we swallow eight spiders per year while we sleep? I have too. And it turns out, it’s not true – not even remotely true. The truth is we swallow about zero spiders in our sleep. You and I will probably never swallow a spider in our sleep in our lifetimes.

And just as we’ve accepted the spider myth as fact, there are plenty of financial planning misconceptions.

What’s one of the topics that comes up most frequently? Social Security. And it’s entirely understandable why.

Social Security is notoriously complicated AND the rules keep changing. It’s also a political hot potato. And to top it off, you only deal with this once in your life.

Let’s clear up some of these misconceptions by looking at five common Social Security myths.

Myth #1: SS won’t be around when I retire.

This is the mother of all Social Security myths – or at least a half-truth. Yes, Social Security is underfunded. It is projected to have its reserves depleted by 2034. But even if no action is taken (I believe it will), FICA taxes will pay for about 80% of scheduled benefits as detailed in the most recent Social Security trustees report.

Here’s how we approach this at Astoria.

For retirees, we generally don’t reduce their benefits for retirement planning projections. Politically, we think current benefits would be extremely hard to touch.

For those nearing retirement, we’ll reduce their stated benefits by 10%.

And for those (like me) who are decades away from retirement, we’ll reduce planned benefits by 25%.

The bottom line? Social Security is underfunded. And some changes will need to be made to shore up the shortfall. But incorporating it into your retirement plan is still prudent.

Myth #2: You don’t pay tax on SS benefits.

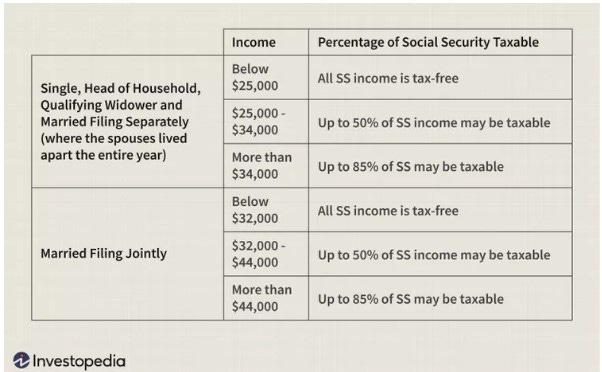

It would be nice if this weren’t true and up until 1983, it was true. But the fact is Social Security benefits CAN be taxed – up to 85% of it, in fact. According to Social Security, 40% of people are taxed on their benefits.

Who is subject to this tax?

For a married couple, those making above $32,000 will have some portion taxed. The chart above is a helpful guide.

Additionally, income is defined as “combined income”. What is combined income? See below.

Myth #3: Since I didn’t pay in, I won’t get a benefit.

The spousal benefit was created in 1939 to address this very issue. Even if you haven’t paid a dime into Social Security if your spouse is insured, you receive a benefit. And this spousal benefit is in addition to the insured’s personal benefit.

How much is the benefit? It can be up to 50% of the insured spouse’s Full Retirement Age (FRA) benefit.

For example: If the insured spouse receives $4,000/month at his/her Full Retirement Age, then their spouse could be entitled to $2,000/month in spousal benefit. This brings the total benefit to $6,000/month.

As you can see, this spousal benefit can have a major impact on your retirement. Don’t leave these benefits by assuming you aren’t entitled to them!

Myth #4: My ex-spouse must approve of me receiving their spousal benefit.

BONUS spousal benefit fact! The spousal benefit also applies to ex-spouses. If you were married to your ex-spouse for at least 10 years and have not remarried, you are entitled to the same benefit.

This filing does not have an impact on your ex-spouse. They do not even need to get involved.

Myth #5: Working part-time after I retire will reduce my benefits.

Your benefit is based on your 35 highest earning years. In addition, those earnings are indexed for inflation.

So, if you have 35 years of earnings history, and the amounts are larger than your part-time earnings, your benefit won’t be impacted.

Closing Thoughts

Social Security is complicated. Even with this series of posts (part 1, 2, and 3), I am just scratching the surface.

The key point throughout this series, though, is this: Become informed about your Social Security benefits and incorporate them into your retirement planning. The best place to start is by downloading and reviewing your Social Security statement.

You can learn a lot just by reviewing that. And if you have further questions, reach out to Social Security or your financial advisor and be confident about maximizing your benefits!

Disclosure: All written content on this site is for information purposes only. Opinions expressed herein are solely those of Astoria Strategic Wealth, Inc. and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Astoria Strategic Wealth, Inc., an SEC Registered Investment Advisor. Being registered as a registered investment adviser does not imply a certain level of skill or training.

The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any State other than the State of Texas and New York or where otherwise legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. All investing involves risk including loss of principal. Past performance does not guarantee future results.

Astoria Strategic Wealth, Inc. is not affiliated with or endorsed by the Social Security Administration or any government agency.

Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former Clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph.