Faith-Based Investing Funds (Pt. 3)

In this post I review the holdings of 3 popular faith-based funds.

In my last post, I reviewed my personal portfolio using Romans 14 as the framework for evaluation. Specifically, I consider what is in my portfolio to be a “disputable matter” (i.e., not black and white) and therefore is a matter of conscience to determine what should/should not be included.

How did my portfolio fare under scrutiny? My conscience was not bothered by what I found. First, most of the companies in my portfolio do provide value to the world (my opinion). Additionally, in my opinion, the companies that don’t are too small to concern me – Philip Morris at 0.28% of my portfolio being an example. I am comfortable with what I’m invested in. Is it perfect? No. Is it good enough for me? Yes.

For argument’s sake, though, what if my conscience was bothered by having tobacco related products in my portfolio? Using this as an example, let’s explore how faith-based investing funds practically address a values-based decision like this.

Eventide Gilead (ETILX)

Eventide’s Gilead (symbol: ETILX) is one of the most popular faith-based funds available. It has over $3 billion in assets and has been around since 2008.

Eventide’s tagline is “Investing that makes the world rejoice” and I’m all-in for that.

So let’s review the fund’s official objectives via its prospectus.

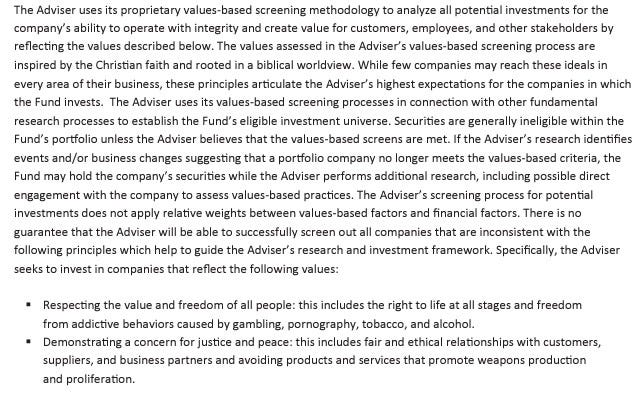

Upon review, I think it’s noble that they aim to invest in companies “inspired by the Christian faith”. I also respect that they admit it’s impossible to invest in companies that adhere to this perfectly by stating, “…few companies reach these ideals in every area of their business.”.

Additionally, they attempt to exclude companies that produce tobacco by seeking to invest in companies that “respect the value of all people” and exclude those that incite “addictive behaviors” like “tobacco”.

So far so good if I’m trying to bless the world and get tobacco out of my portfolio.

Next, let’s look at the actual holdings to see how these ideals are implemented in the fund.

At first glance, I see no immediate red flags – no Philip Morris – so, still looking good.

But what if I dig further and discover that there is a company that ships tobacco products? After all, those tobacco products don’t walk themselves to the shelves of stores. What would that do to the decision?

Well, prepare to be shocked. Old Dominion (ODFL) does, in fact, ship tobacco products – gasp!

Is my conscience bothered by the production but not bothered by the shipment of it? The fund manager says, “no” but what if my conscience is?

This “how much is too much” question is the fundamental problem. Answering this question is personal. Some may be fine with having a small portion of tobacco production (like me), some may be fine excluding the producers but not the shippers, and others may want to exclude production and shipment.

By allowing the fund manager to answer the question, though, you are effectively outsourcing this moral decision to them.

The only true way to ensure alignment of my values is to review each of the fund’s individual holdings and see if they pass the “how much is too much” test. To make matters more complicated, those holdings change (called turnover). So it’s not a one-time decision. It’s ongoing. Personally, I think this is impractical and not likely to be implemented by an individual.

In summary, while I think the overall objectives of the fund are noble, they are too vague to precisely implement. (See: The Derek Zoolander Center for Kids Who Can’t Read Good and Who Wanna Learn to Do Other Good Stuff Too)

A common objective ≠ common holdings

Here is another example that highlights just how personal and subjective this screening exercise is.

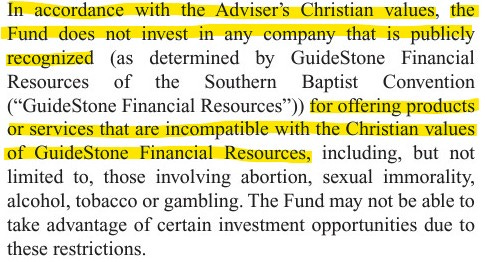

Below are the stated objectives of three faith-based funds: Eventide funds, Inspire funds, and Guidestone funds.

As you can see, they all use very similar language when screening companies (“inspired by Christian faith”, “alignment with biblical values”, and “in accordance with Christian values”).

Given this common mission, you would expect to find commonality in the holdings, right?

Nope. They share no common holdings. There is zero overlap between the three funds in their top ten holdings. In fact, the Guidestone fund has more in common with my portfolio than it does with the faith-based options.

To me, this just further emphasizes the point that these decisions are too personal to outsource. Even funds with almost identical objectives have nothing in common when compared with each other.

Potential solutions: direct indexing or self-directed brokerage

What if you truly are bothered by companies in your portfolio? Are there no solutions?

I think there are more viable solutions to this problem than outsourcing the decision to a fund manager.

The first potential solution is called direct indexing. Direct indexing allows you to pick and choose which specific companies to include/exclude from your portfolio. Want to exclude tobacco producers and shippers? You can do that. Want to only exclude producers? You can do that also. Direct indexing allows you the ability to customize your portfolio based on your personal convictions.

A second potential solution is a self-directed brokerage account, also known as a brokerage window. This is an option in your 401(k) plan (if the plan allows) allowing you to pick individual securities rather than the limited investment options inside your plan.

I think both options are more appropriate if you are truly convicted about companies within your portfolio.

Again, I personally do not use these as I am comfortable with my holdings. But if I wasn’t okay with them, I would consider these as an option.

Conclusion

This post concludes my thoughts concerning the spiritual reasons I don’t invest in these funds. In next week’s post I’ll explore the practical reasons I don’t invest in them - looking at metrics like performance, turnover, and expense ratios. In the meantime, please reach out with any thoughts or questions you have!

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.