Pastor Tax Hack! Five Steps to Pay Your SECA Taxes Using the W-4

Pastors can actually use their dual tax status to make their lives easier! How? Keep reading to learn how to pay your SECA taxes using the W-4.

Pastoral Jiu Jitsu

Pastors have it tough. In addition to your many pastoral duties, you get to navigate the most complicated tax setup known to man.

Housing allowance, housing allowance in retirement, deciding to stay in or out of Social Security (stay in!), and the most confusing of all: dual tax status.

What the heck is dual tax status?

It means pastors are considered employees for income tax purposes and self-employed for Social Security/Medicare tax purposes.

You read that right, pastors act like regular old employees for income taxes but self-employed for Social Security and Medicare.

Confusing, right?

Before you start raining down curses on the IRS, jiu-jitsu that situation into your advantage.

How could you possibly turn this into a positive? Stay with me.

You can actually use this dual-tax status to make your life easier.

Let’s look how, using a 5-step process to pay those Social Security/Medicare taxes (known as SECA) using your W-4.

Step 1: Download your W-4

The first step is to download the most recent W-4 form.

This is where you are going to tell your employer exactly how much to withhold from your paycheck to pay your SECA taxes.

Normally, this form is meant to address income taxes.

But remember the point above about pastors having dual tax status?

Because of this, you can use the W-4 for your SECA taxes as well.

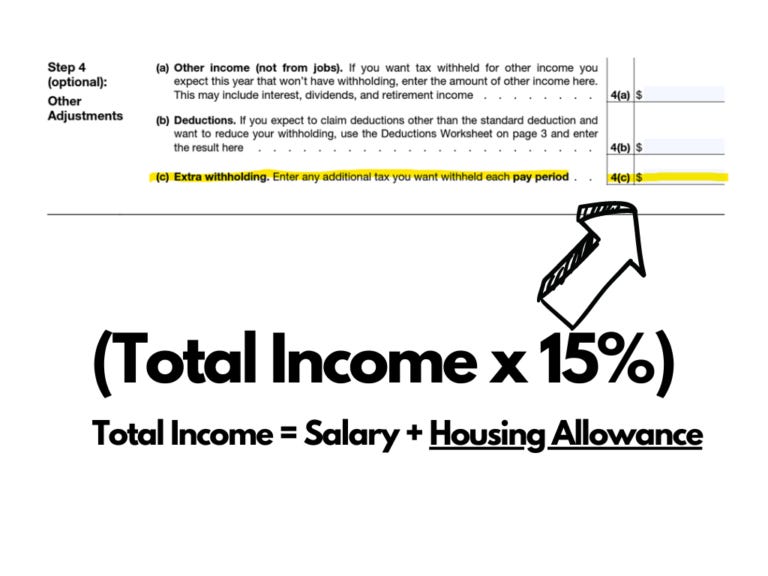

Once you complete Steps 1-3 related to your income tax, Step 4(c) “Extra Withholding” is where the magic happens.

This is where you are going to enter in exactly how much extra you want withheld.

How much should you withhold? Let’s move on to Step 2 to figure out how to calculate your SECA tax.

Step 2: Calculate Your Estimated SECA Tax

To calculate your estimated SECA tax, you want to use the formula below:

Total Income X 15% = Amount to Enter in Box 4(c)

Total Income INLCUDES your housing allowance! For SECA purposes, housing allowance is considered income. So total income is your salary PLUS housing allowance.

Housing Allowance is considered “income” for Social Security purposes but NOT for income tax purposes. Do I understand why? No, I do not.

Step 3: Submit Your W-4

Once you complete your W-4, submit it to your employer’s HR, Executive Pastor, Executive Administrator, etc. to update.

Step 4: Review Your Next Paycheck

After you submit it, make sure to review your next paycheck to ensure the appropriate changes were made. Don’t just assume they were!

Step 5: Revise As Necessary

Once you make these changes, you likely will need to make adjustments and refine the amount being withheld over time.

If this is your first time updating your W-4 you might withhold more tax than is owed.

This is because of the way the housing allowance is treated for tax purposes – not included as income for income tax but included as income for SECA.

Many pastors owe very little in income taxes when you remove the housing allowance and standard deduction from their income and then include dependent tax credits.

But your SECA tax will almost always be greater due to the treatment of housing allowance as income.

And because Social Security and the IRS talk to each other, all that matters is your total tax bill (Income Tax plus SECA).

So basically, if you are withholding 15 % of your total income some of that will likely be refunded to you due to your income tax being so low.

The key here is to use the W-4 to your advantage and refine the amounts withheld as you see fit.

Some people hate owing taxes at year-end and some hate giving the government an interest free loan in the form of a tax refund.

It’s completely up to you.

Wrap-Up

There is no doubt about it, pastors have a very confusing tax situation.

And pastors don’t sign up to be pastors because they are tax experts – they sign up to pastor!

But you can take advantage of this convoluted situation.

Ninja your dual-tax status to your benefit and use the W-4 to pay your SECA taxes!

Disclosure: All written content on this site is for information purposes only. Opinions expressed herein are solely those of Astoria Strategic Wealth, Inc. and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Astoria Strategic Wealth, Inc., an SEC Registered Investment Advisor. Being registered as a registered investment adviser does not imply a certain level of skill or training.

The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any State other than the State of Texas and New York or where otherwise legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. All investing involves risk including loss of principal. Past performance does not guarantee future results.

Astoria Strategic Wealth, Inc. is not affiliated with or endorsed by the Social Security Administration or any government agency.

Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former Clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph.