The 4% Rule is Dead

If I had a nickel for every “the 4% rule is dead” posts I’ve seen, I’d be a rich man.

These posts rank in second place only to “debunking Dave Ramsey” posts as far as generating clicks go.

And while they generate clicks, very few show what retirement spending really looks like.

Today, I’m doing that by looking at six years of actual retirement spending data.

Because the truth is retirement, just like every other season of life, isn’t linear.

The key is to have a financial plan that is dynamic and adapts.

Let’s dive in.

Meet the Retirees

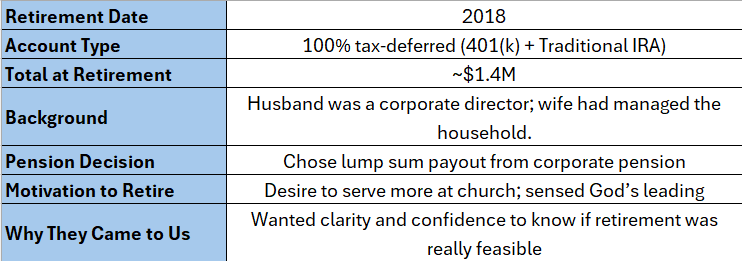

In 2018, this couple came to us with a big question: “Can we retire right now?”

He had just been offered early retirement from his role as a director at a large corporation. His wife had spent most of her time raising their kids and managing the home. As part of the company’s retirement offer, he had the option to take a lump sum from his pension - a big decision.

Their retirement savings were about $1.4 million, all in tax-deferred retirement accounts like a 401(k) and traditional IRAs, but they weren’t sure if that was “enough.”

They’d been praying and sensed God might be leading them into a new season of deeper involvement at their church. They didn’t want to jump without clarity, so they came to us to help answer the “do we have enough” question.

Today, they’re fully retired, and faithfully walking through the journey of retirement. And just like every other retiree I’ve worked with; their plan hasn’t followed a straight line.

Here’s what really happened.

A Real-Life Spending Timeline

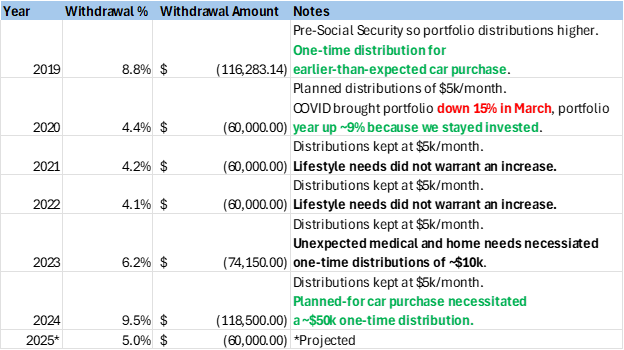

Here is how their plan unfolded in real life, year by year.

And here’s what their actual account value looked like over time. The green line shows what they’ve withdrawn. The yellow shows the total portfolio value.

From 2018 to today, they’ve withdrawn about $575,000. And yet their account has only dropped from $1.4M to ~$1.2M. That’s what a thoughtful, flexible plan can do.

Key Takeaways from a Real Retirement

Here are a few key lessons:

Retirement spending isn’t always a level amount. Some years require more and some less.

Cash flow needs shift. Even planned events (like car purchases) don’t always happen on schedule.

We don’t blindly increase monthly distributions. Even when the plan calls for it (e.g., inflation adjustments), if lifestyle needs don’t change, then the distributions don’t either.

Unexpected expenses happen. When they do, we adapt. Not panic.

This client hasn’t succeeded because we picked the right percentage rule. They’ve succeeded because we stayed flexible, checked in regularly, and kept the plan aligned with their goals.

What is the Real Rule?

Planning is not a one-time event. Especially when you hit retirement. Regular updates help us manage taxes, investments, and most importantly, goals.

A financial plan is a guide not a script.

And what do clients consistently say they value most about this approach?

Almost unanimously they say: “peace of mind”.

So, while the withdrawal percentage rules generate lots of clicks, they don’t make great retirement plans.

If you’re within 5 years of retiring, and your plan still relies on a static rule of thumb it might be time for a check-up.

And if you don’t have a plan, we’d be happy to connect.

Disclosure: All written content on this site is for information purposes only. Opinions expressed herein are solely those of Astoria Strategic Wealth, Inc. and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Astoria Strategic Wealth, Inc., an SEC Registered Investment Advisor. Being registered as a registered investment adviser does not imply a certain level of skill or training.

The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any State other than the State of Texas and New York or where otherwise legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. All investing involves risk including loss of principal. Past performance does not guarantee future results.

Astoria Strategic Wealth, Inc. is not affiliated with or endorsed by the Social Security Administration or any government agency.

Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former Clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph.

It's amazing that they could withdraw $575k and only have their broader account dip by $200k. That is encouraging to hear!

Thanks for sharing, Jake.